arppyup.ru

Tools

How To Open A Roth Ira With Schwab

If you're interested in adding Charles Schwab funds to your Roth IRA, consider Schwab's broad-based stock funds or one of its broad-based bond funds. SIMPLE IRAs are easy to set up and maintain. IRS filing, tax reporting, and compliance testing are not required. Schwab reports all contributions and end-of-. Open a Schwab IRA. Open online or use this form to open an IRA, a SEP-IRA, or a SIMPLE IRA. (Y0). A two-step Roth conversion process · Open a non-deductible traditional IRA and make after-tax contributions. For , you're allowed to contribute up to $6, Move your traditional, SEP-, inherited, or Roth IRA from another company to Vanguard. New to Vanguard and looking to consolidate your savings? Open and. Schwab offers a host of educational tools and resources such as calculators, market commentary, and investing ideas from Schwab experts. Savers can open an. Learn how to start funding your IRA at Schwab in just a few simple steps. Online Transfer. There are no fees to open or maintain an IRA at Schwab. You only pay fees for transactions you make in the account, such as trading stocks, or for investments. By signing this Application, you hereby adopt the Individual Retirement Plan that names Charles Schwab & Co., Inc. as Custodian of this Account. If you're interested in adding Charles Schwab funds to your Roth IRA, consider Schwab's broad-based stock funds or one of its broad-based bond funds. SIMPLE IRAs are easy to set up and maintain. IRS filing, tax reporting, and compliance testing are not required. Schwab reports all contributions and end-of-. Open a Schwab IRA. Open online or use this form to open an IRA, a SEP-IRA, or a SIMPLE IRA. (Y0). A two-step Roth conversion process · Open a non-deductible traditional IRA and make after-tax contributions. For , you're allowed to contribute up to $6, Move your traditional, SEP-, inherited, or Roth IRA from another company to Vanguard. New to Vanguard and looking to consolidate your savings? Open and. Schwab offers a host of educational tools and resources such as calculators, market commentary, and investing ideas from Schwab experts. Savers can open an. Learn how to start funding your IRA at Schwab in just a few simple steps. Online Transfer. There are no fees to open or maintain an IRA at Schwab. You only pay fees for transactions you make in the account, such as trading stocks, or for investments. By signing this Application, you hereby adopt the Individual Retirement Plan that names Charles Schwab & Co., Inc. as Custodian of this Account.

Roth IRA—There's no up-front tax deduction for a contribution to a Roth, but you can withdraw the earnings income tax free at age 59½ if you've held the Roth. After you click “Open a Schwab account,” select the “Roth IRA” link under "Retirement" on the subsequent page to get started. · Because TD Ameritrade is owned by. To open an IRA for a minor, Schwab requires the “Custodial/Minor IRA Account Application.” Most minors benefit from contributing post-tax (Roth) to an IRA. Hey When it comes to opening a Roth IRA account, using an online brokerage can have some benefits. One advantage is that online brokerages. Yes, go to arppyup.ru (since you mention Schwab) and open a Roth IRA. Link your bank account. Transfer $, or set up monthly/weekly transfers. Opening a custodial IRA for your child can be a great way to teach A custodial IRA account can be opened as either a traditional IRA or a Roth IRA. Download a Schwab Custodial IRA application. It helps to have the following information on hand before you open an account: Your Social Security number; Your. Roth IRA. Roth IRA · Roth vs Traditional · Withdrawal Rules · Contribution Limits Click here to open a Schwab account or log in to begin the transfer process. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer. Open a Schwab account online today to start saving, trading or investing. We offer brokerage, IRA, checking and Schwab Intelligent Portfolios online. Until you know and research what fund or stocks you will invest in - you can put the money in the Roth into a Schwab money market. They are. Learn about an individual retirement account, including how to open an IRA, IRA contribution limits, Roth IRA conversions, Roth vs. Traditional IRA calculators. Choice of IRA—A custodial IRA can be opened as either a traditional IRA or a Roth IRA. Go to arppyup.ru to apply to open a custodial IRA. Schwab Custodial. Schwab can help you reach your retirement goals. · $0 Minimum Deposit. Open an account with no minimums and pay $0 for online listed equity trades. · 24/7. Open an account, roll over an IRA, and more Documents available to download. Traditional IRA, Apply Online, Not currently available. Roth IRA, Apply Online. If your plan allows for Roth money, you may open a separate Roth PCRA account. This will allow you to track your Roth investments and earnings separately from. Traditional IRAs and Roth IRAs differ when it comes to who can open an account. Robo-advisor: Schwab Intelligent Portfolios® and Schwab Intelligent Portfolios. Best Roth IRA accounts to open ; Interactive Brokers, $1 minimum/$0 with IBKR Lite, $0 ; Fundrise, Varies, $10 ; Schwab Intelligent Portfolios, Management fee: $0. This plan allows the working spouse to fund a traditional IRA or Roth IRA for a spouse who does not have earned income. To qualify, you must file a joint tax.

Bank Of America Courtesy Overdraft

An overdraft fee ($35) is the cost of using our discretionary overdraft services when you need additional funds to cover a transaction. For members who qualify, Courtesy Pay provides a pre-approved $ overdraft limit to your personal checking account. If you overdraw, we may pay each item up. Balance Connect for overdraft protection allows you to link your eligible checking account with up to 5 eligible Bank of America accounts for overdraft. We can cover your overdrafts in two different ways: 1. We have standard overdraft practices that come with your account. 2. We also offer overdraft protection. Notes: * The median threshold amount to trigger an overdraft fee is $5, and thresholds range from $1 to $ † Bank of America states that customers will. Consent to Courtesy Pay PLUS (CPP) · Log in to Online Banking, click the Tools & Resources menu, and choose Courtesy Pay · Call us at · Stop by any. Please see the Personal Schedule of Fees and Deposit Agreement and Disclosures for your account terms. 1. Our overdraft fee of $10 may apply for overdrafts. Overdrafts and Overdraft Fees. MKT (1/24) a arppyup.ru © American Savings Bank, F.S.B.. We've created a guide to help answer questions. Sir, you cannot use your saving account as overdraft account Unless the Bank of America has permitted you to do so through an approved facility. An overdraft fee ($35) is the cost of using our discretionary overdraft services when you need additional funds to cover a transaction. For members who qualify, Courtesy Pay provides a pre-approved $ overdraft limit to your personal checking account. If you overdraw, we may pay each item up. Balance Connect for overdraft protection allows you to link your eligible checking account with up to 5 eligible Bank of America accounts for overdraft. We can cover your overdrafts in two different ways: 1. We have standard overdraft practices that come with your account. 2. We also offer overdraft protection. Notes: * The median threshold amount to trigger an overdraft fee is $5, and thresholds range from $1 to $ † Bank of America states that customers will. Consent to Courtesy Pay PLUS (CPP) · Log in to Online Banking, click the Tools & Resources menu, and choose Courtesy Pay · Call us at · Stop by any. Please see the Personal Schedule of Fees and Deposit Agreement and Disclosures for your account terms. 1. Our overdraft fee of $10 may apply for overdrafts. Overdrafts and Overdraft Fees. MKT (1/24) a arppyup.ru © American Savings Bank, F.S.B.. We've created a guide to help answer questions. Sir, you cannot use your saving account as overdraft account Unless the Bank of America has permitted you to do so through an approved facility.

When your account becomes overdrawn, you won't be charged an overdraft fee as long as you make a deposit that brings your Available Balance to zero or greater. We'll give you an extra day to cover overdrafts and avoid overdraft fees if you make a deposit by 12AM ET the business day after the overdraft. KeyBank's approval of overdrafts is a discretionary courtesy. For Consumer accounts: No charges will be assessed when the account is overdrawn twenty ($20). We also offer overdraft services, such as a link to a savings or money market account or Yes-Check®, an overdraft line of credit, which may be less expensive. You activate an overdraft facility when a check is presented for payment for an amount greater than the amount in your checking account. With Courtesy Pay, you get added protection, as debit/ATM transactions that result in negative balances are also covered. Plus, Courtesy Pay can kick in if you. Standard Overdraft Privilege—Allows checks, automatic withdrawals, and transactions made using your checking account number (ACH) to clear your account. Check out our bank account without overdraft fees. View FAQs, how-to videos and other resources to help you get started with your new account. Student banking. Courtesy Pay is an overdraft coverage that is available after 60 days upon the opening of a share draft (checking) account type. If you do opt-in for overdraft protection or coverage, then your bank may pay a debit card purchase or ATM transaction, even if the transaction overdraws your. For members who qualify, Courtesy Pay provides a pre-approved $ overdraft limit to your personal checking account. If you overdraw, we may pay each item up. If your Available Balance at the end of the business day is overdrawn by $ or less, an Overdraft Paid Fee will not be charged. U.S. Bank limits the number. We also offer overdraft services, such as a link to a savings or money market account or Yes-Check®, an overdraft line of credit, which may be less expensive. Courtesy Pay is a service that allows us to pay an item presented for payment against your checking account even if it causes the account to become overdrawn. We're now offering Free Overdraft Window, which means new Fifth Third Checking account holders will pay no overdraft fees for the first 90 days. Courtesy Pay is available to personal consumer checking accounts that maintain a regular, recurring direct deposit of $ or more/month. We pay overdrafts at. If you qualify, a line-of-credit can be approved to cover all overdrafts in personal checking accounts up to your approved credit limit. Advances on the line-of. A transaction that exceeds your Available Balance will cause your account to become overdrawn and a $35 overdraft fee will apply. (We do not charge an overdraft fee when the available balance on a personal checking account is overdrawn by $5 or less.) Business day 2 - Assuming no other.

457 B Plan Vs 401k

(k) plans are a popular way for employers to provide tax-favored retirement benefits for their employees. In a (k) plan, an employee can have all or a. plans are tax-advantages retirement plans similar to (k) plans offered by local governments and certain tax-exempt employers. Unlike the (b), the (b) plan is subject to a 10% early withdrawal penalty if you take distributions before you reach age 59 1/2. But like the (b)—and. plans are available to employees of state/local governmental agencies and certain tax-exempt organizations. Some employers offer only a plan. For higher. Roth contributions are not tax deductible, but can be withdrawn tax-free at retirement age, like a Roth IRA. For more info on (k) plans, click here. (b). How a (b) plan differs from a (k) plan · There isn't an additional 10% early withdrawal tax, although withdrawals are subject to ordinary income taxes. Overall, both are very similar but (b) plans have a few more provisions with regards to catch up contributions and early withdrawals. There are two types of plans. A (b) is offered to state and local government employees, while a (f) is for top-level executives at non-profits. The chart below highlights the similarities and differences between the Plan and the (k) Plan as well as contributing on a pre-tax and Roth (after-tax). (k) plans are a popular way for employers to provide tax-favored retirement benefits for their employees. In a (k) plan, an employee can have all or a. plans are tax-advantages retirement plans similar to (k) plans offered by local governments and certain tax-exempt employers. Unlike the (b), the (b) plan is subject to a 10% early withdrawal penalty if you take distributions before you reach age 59 1/2. But like the (b)—and. plans are available to employees of state/local governmental agencies and certain tax-exempt organizations. Some employers offer only a plan. For higher. Roth contributions are not tax deductible, but can be withdrawn tax-free at retirement age, like a Roth IRA. For more info on (k) plans, click here. (b). How a (b) plan differs from a (k) plan · There isn't an additional 10% early withdrawal tax, although withdrawals are subject to ordinary income taxes. Overall, both are very similar but (b) plans have a few more provisions with regards to catch up contributions and early withdrawals. There are two types of plans. A (b) is offered to state and local government employees, while a (f) is for top-level executives at non-profits. The chart below highlights the similarities and differences between the Plan and the (k) Plan as well as contributing on a pre-tax and Roth (after-tax).

For example, when you contribute $ in the (b) Plan or (b) Plan, it really only costs you $75 out of your paycheck (assuming a 25% tax bracket). Why? Similar to (k) plans, (b) and (b) plans allow you to contribute pre (b) or (b) plan to invest in certain investment products. These pre. Provider/participants: (b) plans are provided by governmental and certain non-profit entities, while (k) plans are provided by private employers. Employee. In this guide, we'll delve into the differences between these plans, providing a framework on how to approach these plans & hopefully empowering you. A (a) and (b) plan differ in how they are funded, how withdrawals are treated, and how much can be contributed on an annual basis. The (b) plan features most closely resemble a (k) plan. Key differences among the options include when you can access your funds without a penalty and tax. Rollovers in are allowed from (a), (k), (b),. (b) Governmental Plans, Conduit IRAs and Traditional IRAs. Loans. Only 2 loans allowed across both. However, the most significant advantage of having a (b) plan over (k) plans is that (b) plans allow for early withdrawals without penalty, unlike (k). (k), (b), or plans, or in some cases, from IRAs. Upon termination, you may transfer assets to your new employer's retirement plan or to an IRA. How a retirement plan works Like a (k), a allows you to contribute pretaxed income to the plan, which compounds tax-free until withdrawal. Unlike. By contrast, (k) retirement plans are usually offered by private enterprises. But some big government employees might offer both. Here's how to decide which. A plan includes employer matching contributions in the annual contribution limit, whereas a (k) plan does not. You can withdraw money early from a k is available retirement plan for most companies, including some government, but mostly in private sectors; however, b (and b) are. Employees will go through an enrollment process similar to a (k) or (b). Amounts deferred are vested and will not be taxable until received. Once you. The Savings Plus Program offers (k) and (b) Plans available to most State of California employees, including employees of the Legislature, Judicial. The Roth option lets you contribute after-tax dollars, meaning you pay taxes now. The benefit is that your withdrawals during retirement are tax-free. Traditional contributions to the (k) and (b) plans are made on a before-tax basis and you pay taxes only when you take a distribution. Roth contributions. DEFER” is the name of the voluntary retirement system (b, b and a savings plans) available to most State of Delaware employees including employees. The (b) Plan and (b) Plan are supplemental retirement plans that allow you to save up to the IRS limits for additional savings. Age-based target date funds are the default investment option for the (k) / plans. (k)/(b) Self Directed Brokerage Account Policy · Schwab SDB.

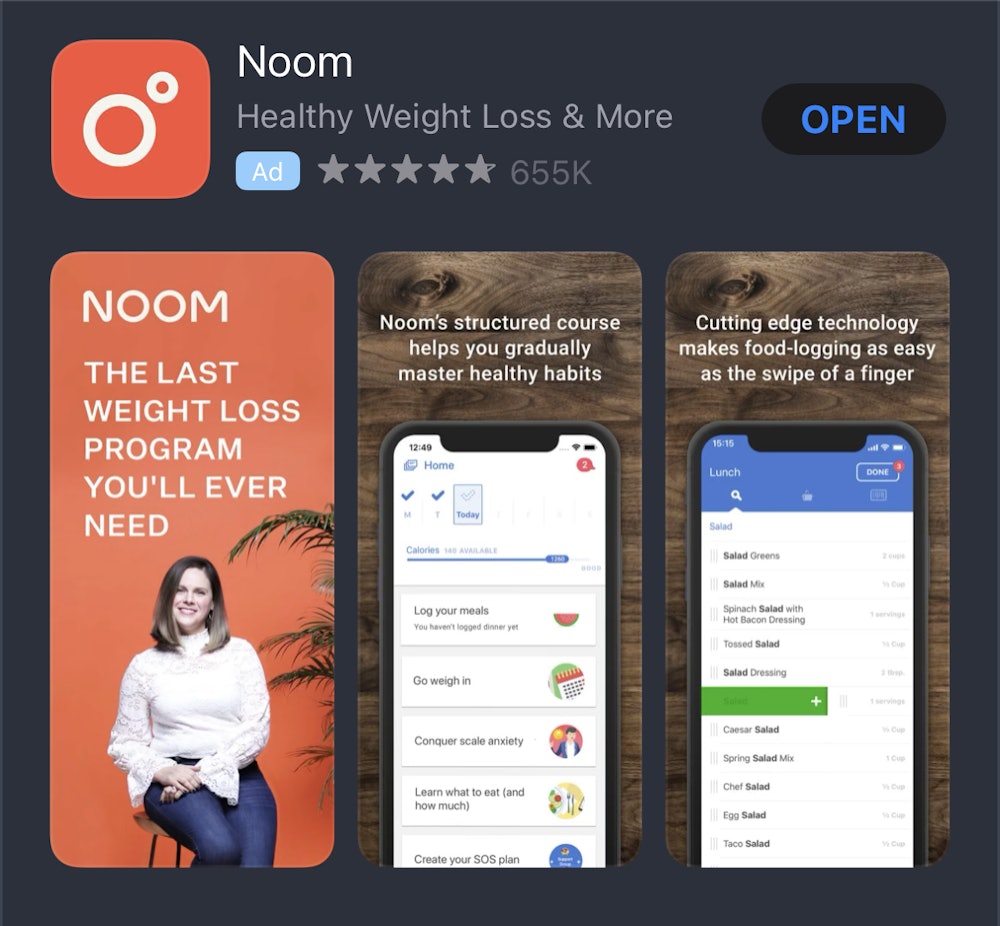

How Did Noom Work

Michaelides: Noom Mood guides Noomers toward improved mental wellness with education, tools and coaching designed to help them manage day-to-day stress. The. It does work if you're motivated enough to lose weight. Unlike other weight loss programs, Noom doesn't force you to eat certain foods or send. I SIGNED UP FOR NOOM AND HAVE *honest* THOUGHTS | noom review from a nutrition coach Does NOOM Work?! | Review of Weight Loss Program After. The Noom Mindset, created by the leading digital health company that has helped millions achieve their weight and health goals, deconstructs habits around the. I SIGNED UP FOR NOOM AND HAVE *honest* THOUGHTS | noom review from a nutrition coach Does NOOM Work?! | Review of Weight Loss Program After. They use a stoplight system, which is by no means anything new, even though that is what they claim. You log your food daily and it seems like you also have to. If you have been wondering, "How does Noom work?" check out this video to see what the Noom app is all about. I have completed the entire. Noom Weight is a weight management program that leverages science and psychology to help you build and maintain new habits that result in healthy weight loss. Noom is a subscription-based app for tracking a person's food intake and exercise habits. The company is known for its emphasis on behavior change and. Michaelides: Noom Mood guides Noomers toward improved mental wellness with education, tools and coaching designed to help them manage day-to-day stress. The. It does work if you're motivated enough to lose weight. Unlike other weight loss programs, Noom doesn't force you to eat certain foods or send. I SIGNED UP FOR NOOM AND HAVE *honest* THOUGHTS | noom review from a nutrition coach Does NOOM Work?! | Review of Weight Loss Program After. The Noom Mindset, created by the leading digital health company that has helped millions achieve their weight and health goals, deconstructs habits around the. I SIGNED UP FOR NOOM AND HAVE *honest* THOUGHTS | noom review from a nutrition coach Does NOOM Work?! | Review of Weight Loss Program After. They use a stoplight system, which is by no means anything new, even though that is what they claim. You log your food daily and it seems like you also have to. If you have been wondering, "How does Noom work?" check out this video to see what the Noom app is all about. I have completed the entire. Noom Weight is a weight management program that leverages science and psychology to help you build and maintain new habits that result in healthy weight loss. Noom is a subscription-based app for tracking a person's food intake and exercise habits. The company is known for its emphasis on behavior change and.

Noom is a new diet app that uses smartphone technology, Visit Site · Read Review. Factor. If you're looking for chef-inspired meals, organic. Noom is a weight loss app that uses psychology to help users change their eating habits. It includes daily lessons, food-logging tools, progress tracking. Noom is a weight-loss app that focuses on diet, exercise and behavioral changes to shift your mindset around food. Noom works by helping you pause and think before the process of eating so that you can 1. Understand why you're eating, 2. Learn about portions. Noom is a weight loss program that's based on the psychology behind your habits and food choices. It focuses on behavioral changes and provides daily lessons. In , Saeju Jeong and Artem Petakov founded Noom because they were dissatisfied with how the American healthcare system focused on sick care instead of. Noom is a weight loss app that uses psychology to change your eating habits for the better through a structured curriculum with education, interactive. Noom is an app-based diet. With a personal coach, chat-based community, and nutrition plan, the app provides motivation and professional guidance for users. Noom is a weight loss and wellness program, delivered through an app on your smartphone. Noom focuses on educating users about nutrition and. Noom What Is Noom? How Does Noom Work? What I Liked About Noom What I Didn't Like About Noom Who Should Use Noom. reviews-noom/ Get EXCLUSIVE content and SUPPORT us: arppyup.ru Intro What is Noom How does Noom work? Noom works by providing users with a personalized weight loss plan. It uses a color-coded system to categorize foods, encourages self-monitoring, offers daily. Noom Weight is a weight management program that leverages science and psychology to help you build and maintain new habits that result in healthy weight loss. They encourage you to track your food and each food is given a color. You're supposed to eat more green and yellow healthy food (and less red varieties). The. They use a stoplight system, which is by no means anything new, even though that is what they claim. You log your food daily and it seems like you also have to. Put into practice, Noom works by setting a daily calorie goal designed to create a caloric deficit. Instead of a specific diet or meal plan, Noom uses a color-. Noom is on a mission to help people live healthier lives by changing long term habits. It is a health app unlike anything else I've seen because. They use a stoplight system, which is by no means anything new, even though that is what they claim. You log your food daily and it seems like you also have to. HOW NOOM WORKS Psychology: Our curriculum uses evidence-based approaches and scientifically-proven principles such as cognitive behavioral therapy (CBT) to. They encourage you to track your food and each food is given a color. You're supposed to eat more green and yellow healthy food (and less red varieties). The.

Saco Bank

Expert assessment of Saxo Bank. If you were to invest in low cost ETFs as part of a passive strategy for the long term, you would benefit from fewer trading. (MLLA) is a licensed insurance agency and wholly owned subsidiary of BofA Corp. Banking products are provided by Bank of America, N.A. and affiliated banks. In Saxo, we believe that money dreams of being in a place with lots of investment opportunities, where it can grow and make a difference—both for you and your. Password. Remember me. Forgot user ID · Forgot password. Log In. Log in on demo account. By logging in, I agree to the disclaimers of Saxo Group. Download the. All our branch locations will be closed on September 2nd for Labor Day! The Contact Center, Video Tellers, and Video Banking will also be closed on August. Register for Online Banking. Bank from home, bank from away. Saco Valley's FREE Home Banking provides access to your accounts 24/7 from a computer. At Saxo we believe that when you invest, you unlock a new curiosity for the world around you. Close this search box. Bank of America. Saxo Bank teamed up with Mastercard for a secure and seamless top-up process, improving the customer experience to increase funding conversion rates. Expert assessment of Saxo Bank. If you were to invest in low cost ETFs as part of a passive strategy for the long term, you would benefit from fewer trading. (MLLA) is a licensed insurance agency and wholly owned subsidiary of BofA Corp. Banking products are provided by Bank of America, N.A. and affiliated banks. In Saxo, we believe that money dreams of being in a place with lots of investment opportunities, where it can grow and make a difference—both for you and your. Password. Remember me. Forgot user ID · Forgot password. Log In. Log in on demo account. By logging in, I agree to the disclaimers of Saxo Group. Download the. All our branch locations will be closed on September 2nd for Labor Day! The Contact Center, Video Tellers, and Video Banking will also be closed on August. Register for Online Banking. Bank from home, bank from away. Saco Valley's FREE Home Banking provides access to your accounts 24/7 from a computer. At Saxo we believe that when you invest, you unlock a new curiosity for the world around you. Close this search box. Bank of America. Saxo Bank teamed up with Mastercard for a secure and seamless top-up process, improving the customer experience to increase funding conversion rates.

Realtime driving directions to TD Bank, 4 Scammon St, Saco, based on live traffic updates and road conditions – from Waze fellow drivers. Top 10 Best Banks & Credit Unions in Saco, ME - August - Yelp - Saco & Biddeford Savings Institution, Atlantic Federal Credit Union, Town & Country. 83 Bank jobs available in Saco, ME on arppyup.ru Apply to Member Services Representative, Customer Service Representative, Teller and more! The Teller I works in a TD Store location and plays a key role in delivering legendary customer experiences while processing everyday banking transactions with. At Saxo we believe that when you invest, you unlock a new curiosity for the world around you. #BeInvested · Philip Heymans Alle 15, Copenhagen How much do bank jobs pay per year in saco, me? · $28, - $42, 3% of jobs · $42, - $56, 2% of jobs · $56, - $69, 3% of jobs · $69, - $83, The BOV Group is a leading financial services provider in Malta, providing retail banking, investment banking, private banking, fund management. Welcome to Saxo Support. How can we help? Search examples: Where do I find reports? - Manage notifications - Place a stop-loss order - Order rejected. Explore all the aspects of whether Saxo Bank is a good choice for beginners. Learn more about Saxo Bank's trading platforms, fees and legitimacy. The main resource for documentation, guides, tutorials, and tools for Saxo Bank's OpenAPI platform products and services. Company profile page for Saxo Bank A/S including stock price, company news, executives, board members, and contact information. Using LaunchDarkly has helped increase Saxo Bank's release frequency from roughly once every 3 weeks, down to twice per week. Saxo has quickly made feature. Saco, ME-The Saco Bank $5 C28 Wait-UNL This is a Perkins note with an date, payable "at their Banking - Available at Orlando, FL. (CAA). Saco & Biddeford Savings is a mutual savings bank with the commitment to offer its customers the best rates and lowest fees possible. BANK OF AMERICA FINANCIAL CENTER, Main St, Saco, ME , Mon - am - pm, Tue - am - pm, Wed - am - pm. Find a Chase branch and ATM in Saco, Maine. Get location hours, directions, customer service numbers and available banking services. Saxo Group - India | followers on LinkedIn. Visit arppyup.ru | Saxo Group - India, located in Candor TechSpace, Sector Saco Food Pantry. Your donations feed the community! Thank you. In the fiscal year, we served 2, families ~. Saco neighbors visiting the pantry, and harnessing relationships with farmers, partners like Good Shepherd Food Bank and retailers in the area. Welcome to KeyBank Saco Office in Saco, ME! Visit your local KeyBank Find a Branch, ATM or Key Private Bank office. Search by city and state or.

Best Hotel Credit Card For Bad Credit

Some hotel cards have no annual fee, or a low enough annual fee that you could recoup the cost with just one hotel stay. On top of that, you'll earn rewards. How to Get a Credit Card with Bad Credit · Credit Card Payoff Calculator. Don't If you travel frequently and are loyal to a particular hotel chain, then hotel. Credit Cards for Bad Credit · Capital One Platinum Secured Credit Card · PREMIER Bankcard® Mastercard® Credit Card · Destiny Mastercard® – $ Credit Limit. Hotel Credit Cards · Capital One VentureOne Rewards Credit Card · IHG One Rewards Premier Credit Card · Capital One Quicksilver Cash Rewards Credit Card · IHG One. If you prefer to keep your vacation expenses low, you might consider looking at what Wyndham Rewards cards, Best Western Rewards cards and the Sonesta World. The World of Hyatt Chase Credit Card is one of the best hotel credit cards. With Should I Get A Co-branded Credit Card? The 5 Best Credit Cards for Bad. Find hotel credit cards from Mastercard. Compare cards from our partners, view offers, and apply online for the credit card that best fits your needs. Best Low-Cost Hotel Credit Card. Marriott Bonvoy Boundless Credit Card. Read more Best Credit Cards for Poor Credit · Best Credit Cards for Bad Credit. Best Bad Credit Personal Loans Another card to consider: The Capital One VentureOne Rewards Credit Card offers a similar rewards structure and carries no. Some hotel cards have no annual fee, or a low enough annual fee that you could recoup the cost with just one hotel stay. On top of that, you'll earn rewards. How to Get a Credit Card with Bad Credit · Credit Card Payoff Calculator. Don't If you travel frequently and are loyal to a particular hotel chain, then hotel. Credit Cards for Bad Credit · Capital One Platinum Secured Credit Card · PREMIER Bankcard® Mastercard® Credit Card · Destiny Mastercard® – $ Credit Limit. Hotel Credit Cards · Capital One VentureOne Rewards Credit Card · IHG One Rewards Premier Credit Card · Capital One Quicksilver Cash Rewards Credit Card · IHG One. If you prefer to keep your vacation expenses low, you might consider looking at what Wyndham Rewards cards, Best Western Rewards cards and the Sonesta World. The World of Hyatt Chase Credit Card is one of the best hotel credit cards. With Should I Get A Co-branded Credit Card? The 5 Best Credit Cards for Bad. Find hotel credit cards from Mastercard. Compare cards from our partners, view offers, and apply online for the credit card that best fits your needs. Best Low-Cost Hotel Credit Card. Marriott Bonvoy Boundless Credit Card. Read more Best Credit Cards for Poor Credit · Best Credit Cards for Bad Credit. Best Bad Credit Personal Loans Another card to consider: The Capital One VentureOne Rewards Credit Card offers a similar rewards structure and carries no.

If you have a general travel spend, like booking with hotels/expedia/airbnb etc then a general travel card that will get good rewards no matter. Credit Cards with No Annual Fee · Low Intro APR Balance Transfer Credit Cards luxury hotel collection and concierge service. Redeem for cash back as. With perks meant to attract business owners who make Marriott Bonvoy hotels their home away from home, and with a relatively low annual fee, the Marriott Bonvoy. Compare best travel credit cards for poor credit; Closer look at the best bad credit travel credit cards; How to choose the best travel card for bad credit; How. loans for good and bad creditBest auto loans refinance loansBest lease buyout loans Credit CardsAirline Credit CardsLow Interest and No Fee Credit Cards. The Capital One VentureOne is a great low-cost choice for anyone who is just starting out in the travel rewards space. Not only is there no annual fee, but you. Credit Cards for Bad Credit · Capital One Platinum Secured Credit Card · PREMIER Bankcard® Mastercard® Credit Card · Destiny Mastercard® – $ Credit Limit. If you prefer to keep your vacation expenses low, you might consider looking at what Wyndham Rewards cards, Best Western Rewards cards and the Sonesta World. The good news: Canada does have a hotel credit card. The bad news: There's only one—the American Express Marriott Bonvoy—that lets you earn and redeem points. Look for cards with a high intro bonus and a low spending requirement. Rewards. Hotel rewards credit cards reward you with points redeemable for free nights in. How to Get a Credit Card with Bad Credit · Credit Card Payoff Calculator. Don't If you travel frequently and are loyal to a particular hotel chain, then hotel. Marriott Bonvoy Boundless® Credit Card*: Best low-annual-fee Marriott card. The Platinum Card® from American Express: Best for elite status with Marriott and. Chase Sapphire Preferred® Card The Chase Sapphire Preferred Card is one of our favorite travel credit cards overall due to its high rewards rate and low. Start your journey by finding the best travel credit card from Chase. Compare travel rewards benefits and offers including dining perks, and new signup. Why we chose it: The Capital One VentureOne is a great low-cost choice for anyone who is just starting out in the travel rewards space. Not only is there no. Compare best travel credit cards for poor credit; Closer look at the best bad credit travel credit cards; How to choose the best travel card for bad credit; How. Best cardsExcellent creditGood creditFair creditBad creditLimited creditBalance transferRewardsSecuredCash backNo annual feeStudentPremium RewardsAll cards. Best Bad Credit Personal Loans Another card to consider: The Capital One VentureOne Rewards Credit Card offers a similar rewards structure and carries no. Find Visa credit cards with low interest rates, rewards and other benefits Excellent, Good / Excellent, Fair, Poor Credit / Rebuilding. Apply. Select to. Card Art Milestone Mastercard® - $ Credit Limit. **Recommended Credit. Good-Fair-Poor-Bad. Milestone Mastercard® - $ Credit Limit. Write a Review Add to.

Money Market Broker

In the UK, a broker who arranges short-term loans in the money market, i.e. between banks, discount houses, and dealers in government securities. A Money Market fund is a mutual fund that invests in short-term, higher quality securities. Designed to provide high liquidity with lower risk. Money market funds are short-term cash investments that seek to preserve your savings. Learn their benefits and how to use them. Merrill offers access to a variety of money market mutual funds (money market funds) and bank deposit solutions designed MLPF&S is a registered broker-dealer. Money market funds are a type of mutual fund that invests in low-risk, short-term debt securities, such as Treasury bills, municipal debt, or corporate bonds. A wide range of investing types. Trade stocks, ETFs, options, no-load mutual funds, money markets, and more. Simple, transparent pricing. $0 minimum to open. Money market funds are a low-risk investing option offered by banks, brokerages and mutual fund companies. Use Bankrate to find the best money market funds. This article') describes the role of broking firms in the London markets through which banks and other financial institutions conduct their money-market. The money market specializes in very short-term debt securities (debt that matures in less than one year). In the UK, a broker who arranges short-term loans in the money market, i.e. between banks, discount houses, and dealers in government securities. A Money Market fund is a mutual fund that invests in short-term, higher quality securities. Designed to provide high liquidity with lower risk. Money market funds are short-term cash investments that seek to preserve your savings. Learn their benefits and how to use them. Merrill offers access to a variety of money market mutual funds (money market funds) and bank deposit solutions designed MLPF&S is a registered broker-dealer. Money market funds are a type of mutual fund that invests in low-risk, short-term debt securities, such as Treasury bills, municipal debt, or corporate bonds. A wide range of investing types. Trade stocks, ETFs, options, no-load mutual funds, money markets, and more. Simple, transparent pricing. $0 minimum to open. Money market funds are a low-risk investing option offered by banks, brokerages and mutual fund companies. Use Bankrate to find the best money market funds. This article') describes the role of broking firms in the London markets through which banks and other financial institutions conduct their money-market. The money market specializes in very short-term debt securities (debt that matures in less than one year).

A financial market is a place where firms and individuals enter into contracts to sell or buy a specific product, such as a stock, bond, or futures contract. IBKR has one of the largest Mutual Fund Marketplaces, with funds from Allianz, American Funds, BlackRock, Fidelity, Franklin Templeton, Invesco, MFS, PIMCO. Individual investors can buy them directly from the government through the TreasuryDirect website or a bank or a broker. State, county, and municipal. Money market funds are short-term cash investments that seek to preserve your savings. Learn their benefits and how to use them. Money market funds are a type of mutual fund that invests in low-risk, short-term debt securities, such as Treasury bills, municipal debt, or corporate bonds. A money market fund (MMF) is a type of mutual fund that invests in cash, cash equivalents and short-term debt securities. Tiger Brokers has an innovative cash management feature called Tiger Vault. Any idle cash above $1 gets swept automatically into a money market. A money market mutual fund is a professionally managed fund that buys money market securities on behalf of individual investors. Functions of the Money Market. Money Market Holdings · FINRA BrokerCheck; Manage cookies. This information is intended for US residents. Invesco Distributors, Inc. is the US distributor for. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. A money market fund is a type of mutual fund that invests in high-quality, short-term debt instruments and cash equivalents. For the most part, money markets provide those with funds—banks, money managers, and retail investors—a means for safe, liquid, short-term investments, and they. Money market mutual funds, often thought of as cash, are protected as securities by SIPC. SIPC protects cash held by the broker for customers in connection. When you open a JP Morgan Self-Directed account, you'll get access to competitive yields on money market funds and up to $ cash bonus. Non-bank financial Institution; Money Market Funds & Corporate; Money Market Brokers. Repurchase/ Repo: A repurchase agreement is the sale of a security with a. The major participants in the money market are governments, commercial banks, corporations, government-sponsored enterprises, money-market mutual funds, brokers. The dealers send quotes to the broker who, in effect, broadcasts the information by telephone. Brokers often provide trading platforms such as dark pools to. Ameriprise® Insured Money Market Account (AIMMA) AIMMA is an interest-bearing bank deposit arrangement available in Ameriprise brokerage accounts that. § Exemption for banks effecting transactions in money market funds. (a) A bank is exempt from the definition of the term “broker” under section 3(a)(4). The money market is a component of the financial system that provides short-term trading, lending or funding activities with a maturity of up to one year.

How To Learn To Do Stock Trading

In summary, here are 10 of our most popular stock trading courses ; Practical Guide to Trading · Interactive Brokers ; Financial Markets · Yale University ; Trading. Online trading is safe if you use a regulated online stock broker and never invest more than you are willing to lose. Trading stocks online is inherently risky. To trade stocks, you need to set clear investment goals, determine how much you can invest, decide how much risk you can tolerate, pick an account at a broker. 5 stock investment tips for beginners · 1. Use your personal brand knowledge · 2. Know the fundamentals · 3. Use technical indicators to spot trends · 4. Do the. Stocks represent ownership in public companies; buying shares makes you a part-owner. · Stock market prices are driven by supply and demand dynamics. · Market. To start trading stocks, you could practice with a demo trading account and devise a trading strategy that works for you. Once you are ready to trade with real. We are Sarwa · Understand how the stock market works · Create a trading plan · Practice and improve your trading plan · Select a trading platform · Open an account. Stocks, also known as equities, are a security representing partial ownership of a publicly traded company. So, when you buy stocks in a company, it means you. Study the fundamental and technical analysis of the stock to plan your trading. Fundamental analysis evaluates security by measuring its intrinsic value. It. In summary, here are 10 of our most popular stock trading courses ; Practical Guide to Trading · Interactive Brokers ; Financial Markets · Yale University ; Trading. Online trading is safe if you use a regulated online stock broker and never invest more than you are willing to lose. Trading stocks online is inherently risky. To trade stocks, you need to set clear investment goals, determine how much you can invest, decide how much risk you can tolerate, pick an account at a broker. 5 stock investment tips for beginners · 1. Use your personal brand knowledge · 2. Know the fundamentals · 3. Use technical indicators to spot trends · 4. Do the. Stocks represent ownership in public companies; buying shares makes you a part-owner. · Stock market prices are driven by supply and demand dynamics. · Market. To start trading stocks, you could practice with a demo trading account and devise a trading strategy that works for you. Once you are ready to trade with real. We are Sarwa · Understand how the stock market works · Create a trading plan · Practice and improve your trading plan · Select a trading platform · Open an account. Stocks, also known as equities, are a security representing partial ownership of a publicly traded company. So, when you buy stocks in a company, it means you. Study the fundamental and technical analysis of the stock to plan your trading. Fundamental analysis evaluates security by measuring its intrinsic value. It.

Start your journey with a focus on the fundamentals, gain a deeper understanding of the daily activities of a trader, then proceed to focus on technical. How do stocks work? A stock represents a share in the ownership of a company, including a claim on the company's earnings and assets. As such, stockholders. Do your research. Read everything you can. Never stop learning about the market. You can even practice with virtual money before actually investing. Once you've. 8 steps to start trading · Understand how trading works · See examples of trades · Research the available markets · Know the risks of trading and how to manage them. How to trade stocks · 1. Pick a brokerage account · 2. Research investment options · 3. Create a trading plan and exit strategy. Stock trading for beginners involves considering your overall investment aims and your reasons for investing. Your risk-profile will dictate which types of. The best way to learn stock trading is by following the market through business websites and channels. Learn to trade with our newly expanded library of trading education, including trading courses, articles, videos, and more. Get a financial advisor · Start investing in your k or IRA · Invest your spare change with a company like Acorns or Stash · Take basic stock trading courses. Types of Stocks. Quiz on Stock Basics. 5 questions. Why do Stock Prices Move? Going Deeper2 lectures • 11min. The Stock Exchange and the Markets. Courses to get you started · Most popular · Stock Market Investing for Beginners · Investing In Stocks The Complete Course! · The Complete Foundation Stock Trading. In summary, here are 10 of our most popular stock market courses · Financial Markets: Yale University · Practical Guide to Trading: Interactive Brokers · Trading. IBD's online courses give you essential lessons on how to make more money in the stock market. Follow along at your pace and on your schedule. Day Trading. Do you actively trade stocks? If so, it's important to know what it means to be a "pattern day trader" (PDT) because there are requirements. Anyone can learn to invest wisely with this bestselling investment system! Through every type of market, William J. O'Neil's national bestseller, How to Make. Trading Academy is a leader in investing and stock trading education. Sign up for a class today to learn step-by-step strategies on how to trade smarter. AvaAcademy, powered by AvaTrade, is one of the best online trading academies there is. Learn how to trade Stocks, Crypto, Forex, Indices and Commodities from. Online trading is safe if you use a regulated online stock broker and never invest more than you are willing to lose. Trading stocks online is inherently risky. Stocks represent ownership in public companies; buying shares makes you a part-owner. · Stock market prices are driven by supply and demand dynamics. · Market. To start trading stocks, you could practice with a demo trading account and devise a trading strategy that works for you. Once you are ready to trade with real.

Can You Intermittent Fast 5 Days A Week

If you skip intermittent fasting for a few days, don't overdo it and try to stick to healthy foods. . Written by. Jill Lebofsky. 15+yr Women's Wellness Expert. You might do the time-restricted fasting (fast for 16 hours, eat for 8, for instance) every other day or once or twice a week, Shemek says. What that means is. Intermittent fasting is when you alternate between eating and fasting. Some schedules include fasting two days a week or eating only during certain hours. You eat pretty much what you like within reason, still relatively healthy of course. It is recommended to eat a 'normal' number of calories five days a week and. The diet The intermittent fasting schedule involves fasting two days a week. On these two fasting days, you limit your intake to calories (if you'. It is often compared to fasting, but the two strategies are slightly different. Time-restricted eating limits the number of hours per day that you can eat. A. Intermittent fasting 5 days a week with hour daily fasts sounds like a reasonable plan- as long as you're tailoring it appropriately for. Another program called the Fast Diet involves eating 5 days a week and fasting for the other 2 days, when women can get no more than calories and men no. What is intermittent fasting? Does it have health benefits? · Alternate-day fasting. Eat a normal diet one day and either completely fast or have one small meal. If you skip intermittent fasting for a few days, don't overdo it and try to stick to healthy foods. . Written by. Jill Lebofsky. 15+yr Women's Wellness Expert. You might do the time-restricted fasting (fast for 16 hours, eat for 8, for instance) every other day or once or twice a week, Shemek says. What that means is. Intermittent fasting is when you alternate between eating and fasting. Some schedules include fasting two days a week or eating only during certain hours. You eat pretty much what you like within reason, still relatively healthy of course. It is recommended to eat a 'normal' number of calories five days a week and. The diet The intermittent fasting schedule involves fasting two days a week. On these two fasting days, you limit your intake to calories (if you'. It is often compared to fasting, but the two strategies are slightly different. Time-restricted eating limits the number of hours per day that you can eat. A. Intermittent fasting 5 days a week with hour daily fasts sounds like a reasonable plan- as long as you're tailoring it appropriately for. Another program called the Fast Diet involves eating 5 days a week and fasting for the other 2 days, when women can get no more than calories and men no. What is intermittent fasting? Does it have health benefits? · Alternate-day fasting. Eat a normal diet one day and either completely fast or have one small meal.

I spaced my meals to every four hours throughout the day and cut out snacks, especially ones before bed. I committed to starting my fasting window between 7 and. The diet hit the headlines thanks to British journalist Dr Michael Mosley and his New York Times bestseller The Fast Diet. This style of intermittent. diet, when you choose 2 days each week to have only a small amount of If you are intermittent fasting, a dietitian can advise you about what foods you. How to do it The New approach involves restricting calories to on fasting days, then eating a healthy lower carb, Mediterranean-style diet for the. Fasting for 2 days a week People following the diet eat standard amounts of healthful food for 5 days and reduce calorie intake on the other 2 days. On 2 days a week, you have only very small amounts of calories, often between and On the other 5 days, you eat as usual. Generally, people space out. If planned well, a hour intermittent fasting diet provides you with many long-lasting health benefits. It is one of the easy diets to follow. But initially. The most common IF dietary strategies include a daily fast for 16 hours, a h fast on alternate days, or a fast 2 days per week on nonconsecutive days. diet: With this method, it involves a 5-day eating and a 2-day fasting, either consecutively or non-consecutively in each week. you to eat every other day. On a 'fast' day, you would typically consume between and calories. Some studies have linked this diet to lower rates of coronary heart disease, but more. one day, and then you eat the next day, and you go back and forth like that. Again, it will be rough because it takes days to adapt. I. How does Intermittent Fasting work? When following a style diet, the 2 fasting days per week place your body into an overall calorie-deficit for the week. Intermittent fasting refers to a patterned eating regimen in which you refrain from eating for some portion of the day. Two popular methods include the weekly fasting entails consuming % of normal calories on two non-consecutive days per week. For example, on a calorie diet, one would consume Time-restricted eating (TRE): Includes set fasting and eating windows and is practiced between one and seven days per week. · Twice-a-week () method. There are other forms of 'intermittent fasting', including the approach, which involves very restricted eating on two days of the week, with normal eating. weekly fasting entails consuming % of normal calories on two non-consecutive days per week. For example, on a calorie diet, one would consume The diet is a simple diet regimen that involves eating anything you want for 5 days in a week, and restricting calorie consumption to 25% of normal. The diet: Involves eating normally for 5 days of the week and restricting calorie intake to calories for 2 days of the week. Alternate-day.

Refinance Parent Plus Loans

Calculate your savings with Purefy's Parent PLUS Loan Refinance Calculator and see the effects of a lower rate and faster payoff. The major federal benefits that would be lost by refinancing a Parent PLUS Loan are * To switch to the ICR plan you would need to contact your student loan. Refinancing a Parent PLUS loan combines your Parent PLUS loan (and any other loans the student has) into a brand-new loan – often, with a lower interest rate. If you took out a loan at a high interest rate, refinancing could help you lower it. You may have taken out a federal Parent PLUS loan and not realized you had. Private education loans are not eligible for consolidation. Direct PLUS Loans received by parents to help pay for a dependent student's education cannot be. Check out SoFi's Parent Plus Loan rates and see how they compare to your current payment situation. Best Lenders to Refinance Parent PLUS Loans · Citizens Bank · Education Loan Finance · PenFed Credit Union · Laurel Road · SoFi® · Earnest · Iowa Student Loan. PLUS loans can be more expensive than private parent loans. Our refinance specialist can help you find the best rate and term to start saving when. The short answer is yes, you can refinance your Parent PLUS loan. Doing so could reduce your interest rate or monthly payments, or help you transfer your PLUS. Calculate your savings with Purefy's Parent PLUS Loan Refinance Calculator and see the effects of a lower rate and faster payoff. The major federal benefits that would be lost by refinancing a Parent PLUS Loan are * To switch to the ICR plan you would need to contact your student loan. Refinancing a Parent PLUS loan combines your Parent PLUS loan (and any other loans the student has) into a brand-new loan – often, with a lower interest rate. If you took out a loan at a high interest rate, refinancing could help you lower it. You may have taken out a federal Parent PLUS loan and not realized you had. Private education loans are not eligible for consolidation. Direct PLUS Loans received by parents to help pay for a dependent student's education cannot be. Check out SoFi's Parent Plus Loan rates and see how they compare to your current payment situation. Best Lenders to Refinance Parent PLUS Loans · Citizens Bank · Education Loan Finance · PenFed Credit Union · Laurel Road · SoFi® · Earnest · Iowa Student Loan. PLUS loans can be more expensive than private parent loans. Our refinance specialist can help you find the best rate and term to start saving when. The short answer is yes, you can refinance your Parent PLUS loan. Doing so could reduce your interest rate or monthly payments, or help you transfer your PLUS.

When you're ready to accept your loan, you can choose to refinance less than the requested amount (as long as it's above $5,) or up to % of your approved. Although refinancing federal parent PLUS loans may not be the right choice for everyone, here are five examples of when doing so might be the right thing for. Parent Refinance Loans Are you paying off high-interest federal Parent PLUS loans or private parent loans for your child? Refinancing with us could help you. Under this loan program, parents may borrow up to the cost of education at a particular institution minus any financial aid a student receives. Repayment of a. Parent plus loans can only be refinanced into the students name which turns them into private loans. You will not be able to get the loans into. Refinancing your existing student loans allows you to combine multiple loans into a single loan, making payments more manageable. A Parent Direct PLUS loan can be consolidated into a Direct Consolidation Loan in order to have the Income Contingent Repayment Plan option within the Federal. As long as the student can qualify to refinance on their own, they can assume full responsibility for the debt. But knowing whether this is a good idea isn't. Steps to Refinance Parent Plus Loans: · Two different ways to refinance Parent Plus loan: either initiated by the parent or the student. · If you're the student. Save up to thousands of dollars when you refinance with a low fixed or variable rate. Flexibility. Choose a student loan repayment term from years. Our fast and intuitive online process could help you refinance your Federal Parent PLUS loan or private parent loan to a lower rate or shorter term. Among the types of refinancing options for a Parent PLUS loan are converting a single high-interest Parent PLUS loan into a single lower-interest private loan. Borrowers can refinance their Parent PLUS loans, and even combine them with their private student loans. For this reason, Select ranked Education Loan Finance . Save money on interest costs by getting a lower rate. Pay off your loans more quickly by shortening your repayment term. Make your monthly payments lower and. Parent PLUS loans provide federal funding for parents of undergrads. While these fixed-rate loans are generally affordable, parents must pay an origination fee. The federal government does not allow Parent PLUS Loans to be refinanced, but only consolidated through a Direct Consolidation Loan, and private loans can not. Just remember that you need your child's permission before refinancing your Parent PLUS Loans in their name. Other Student Loans for Parents. Parent PLUS Loans. Private education loans are not eligible for consolidation. Direct PLUS Loans received by parents to help pay for a dependent student's education cannot be. Parent PLUS loans do NOT qualify for all of the income-driven repayment plans and loan forgiveness programs. If you combine other loans with Parent PLUS, you. The key to using the double consolidation loophole is to consolidate each of your Parent PLUS Loans twice. In this scenario, a borrower can have as few as two.